How To Set Up an Online Store with PayPal and Start Accepting Payments

Our independent research projects and impartial reviews are funded in part by affiliate commissions, at no extra cost to our readers. Learn more

Running an online store is a modern-day ambition for many entrepreneurs. But are you stumped on how to actually start accepting payments online? You’re not alone, and doing something like setting up a secure payment system can feel daunting if you’re new to ecommerce.

What if we told you there’s an easy way to enable customer purchases through one of the internet’s most trusted payment processors? Keep reading to discover how integrating PayPal with your online storefront can help you clear that major hurdle and kick your entrepreneurial dreams into high gear.

Why Small Businesses Use Paypal

Let’s face it: when you’re running a small business website, time is precious, and the budget is limited. For that reason, so many entrepreneurs turn to PayPal for their online payment needs. It’s a widely-trusted platform that makes life easier on multiple fronts.

Convenience Is Key for Any Busy Business Owner

With PayPal, your customers can pay using a wide variety of methods—credit cards, debit cards, PayPal balance, PayPal Credit, or even a PayPal cash account. There’s no need for shoppers to juggle separate systems for different payment types. PayPal easily handles it all in one place.

Top-Notch Security

But convenience doesn’t mean compromising on security. Quite the opposite, as PayPal has robust, industrial-strength security measures to protect both buyers and sellers from fraud and hacking attempts. It includes:

- Advanced encryption

- Anti-fraud models

- Dedicated security specialists

So you and your customers can check out with true peace of mind.

Neutral

PayPal’s neutrality as a third-party processor is also a huge benefit. If any issues or disputes arise, you can trust they’ll be resolved fairly and objectively, not favoring one side over the other. There’s no shady business—just an impartial referee to ensure everyone gets treated right.

All-Inclusive Transactions

Speaking of fairness, PayPal takes an all-inclusive approach to transactions. It handles every aspect, from invoicing to payment collection to dispute resolution, eliminating extra hassles. Small business owners have enough on their plate already. Letting PayPal sweat those logistical details lets you focus your energy where it really counts, like actually running your business.

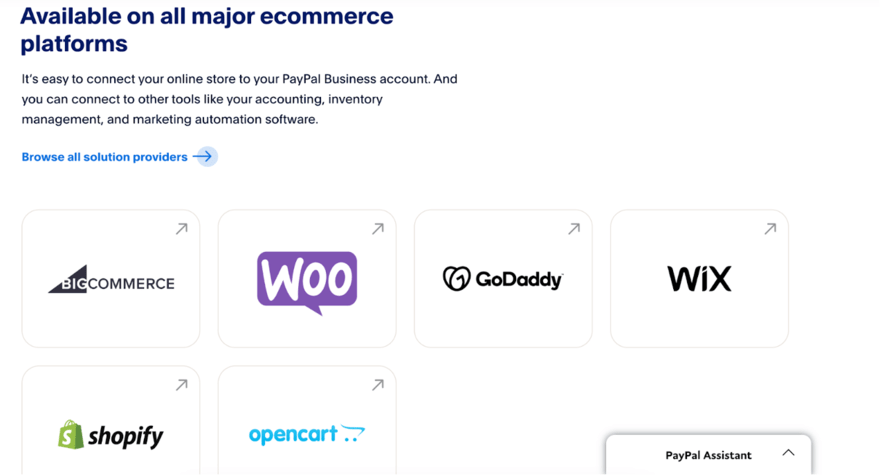

The facts speak for themselves: PayPal is trusted by hundreds of millions of users across the globe, including some of the world’s biggest brands. But its platform is just as popular among solopreneurs and small businesses. Part of that appeal is the fact PayPal partners with all the major ecommerce builders like Wix, Shopify, and more to provide a seamless experience.

PayPal Fees

Let’s talk about what you can expect to pay when using PayPal for your online store. The good news is PayPal keeps its fee structure nice and straightforward. There are really just two main areas to focus on: monthly fees and transaction fees.

No Monthly Fees (for the Most Part)

PayPal doesn’t charge any monthly fees to maintain your account or accept payments online. Its pricing is purely transaction-based, which means you only pay fees when you actually make a sale.

If, however, you’re dipping your toes into some of PayPal’s other features, you may be required to pay monthly fees. For instance, Payflow Pro is a customizable payment gateway offered by PayPal that has a monthly fee associated with it. The service allows merchants to build custom checkouts and is charged at $30 per month for Payflow Pro, plus a $0.10 fee per transaction.

Transaction Fees

For online sales, PayPal charges a standard rate of 2.9% of the total payment amount, plus a fixed $0.30 fee per transaction. As an example, for a $50 sale, you would owe PayPal $1.75 (2.9% of $50 = $1.45 + $0.30 fixed fee).

It’s worth noting that the rate applies to domestic transactions. International transactions have different rates. Let’s say your account is US-based, but the funds received from a PayPal account come from a different country. In this scenario, the fees for an entirely online transaction would be 4.4% + a fixed fee based on the currency.

Start for Free

You don’t need to pay anything to get started with PayPal for your online store. Just create a free PayPal Business account, connect it to your website, and you’re ready to start selling immediately. PayPal won’t charge you any fees until you actually start receiving online orders and payments from customers.

PayPal’s pricing follows a simple model with no surprises. There are no monthly hurdles for receiving payments—just manageable transaction rates that align with standard industry costs for online payment processing. This allows you to easily integrate PayPal and test it out risk-free until your business starts successfully taking off.

Setting Up an Online Store With PayPal

Setting up PayPal to accept payments for your online store is refreshingly straightforward. We’ll walk through the process step-by-step so you can start generating revenue quickly and smoothly.

Just follow these simple steps:

1) Create an Online Store

Building an online store presence doesn’t have to be difficult. With an ecommerce website builder, you get access to stylish templates, simple editing tools, and built-in sales features. Just select the template you like, add your products and key information, and then publish when ready. Some builders, like Wix, even offer free plans to get started on a tight budget.

However, don’t rush this step. Think through your business priorities—are you looking for advanced inventory management or multichannel integration to sell across platforms? Make sure to choose a website builder that provides the right ecommerce capabilities for your needs.

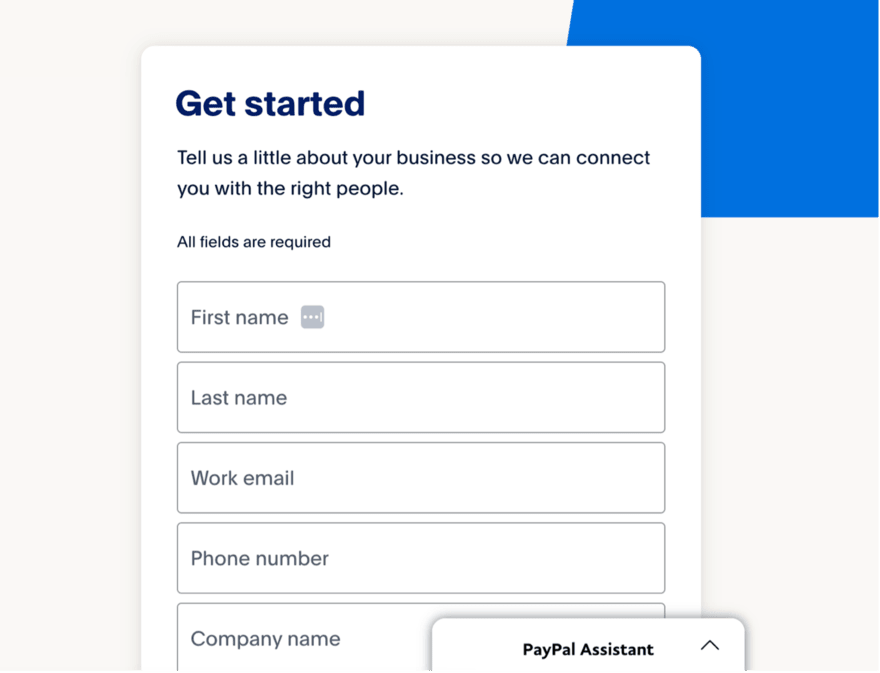

2) Create a PayPal Business Account

You’ll need to sign up for a PayPal Business account if you don’t already have one. This is different from a normal PayPal account used for casual payments between friends and family. A Business account gives you added functionality to integrate PayPal into your website.

Head to PayPal and click “Sign Up“, then follow the steps to complete your registration, including verifying your email, phone number, and business details. Make sure you accurately portray what your business sells for the smoothest account setup.

3) Connect PayPal to Your Online Store

With your PayPal Business account created, it’s time to integrate it into your ecommerce website. The exact steps will vary slightly depending on which website builder you use:

- Wix: Go to your Wix dashboard > Select “Payments” > Click “Connect PayPal” and follow the steps.

- Squarespace: Go to Settings > Payments > Click “Connect PayPal Account.”

- Shopify: From your Shopify admin, go to Settings > Payments > “Connect a payment provider” and follow the steps for PayPal.

Most builders will walk you through the integration process with clear prompts. Don’t hesitate to reference their help documentation if needed. This is a really important step to make sure your PayPal is properly connected so you can start accepting orders!

4) Set Up PayPal Payments

With PayPal successfully integrated, you can now configure your payment settings for the customer experience you want to provide. This may include:

- Deciding which PayPal payments to accept (one-time purchases, recurring payments, etc.)

- Setting up shipping rates and policies

- Adding sales tax rates, if required

- Adjusting currency options for international buyers

Just remember to take time to review all the available settings. The goal is to create a seamless, hassle-free checkout experience for your customers to encourage more sales and reduce cart abandonment.

5) Start Selling with PayPal

That’s it—you’re all set to begin accepting PayPal payments on your online store! As customers land on your website, they’ll see the trusted PayPal icon at checkout. That iconic logo is widely recognized and provides an extra confidence boost as well as a sense of security for buyers to complete their purchases.

What Else Should I Know About PayPal?

From here, you can take advantage of PayPal’s full slate of sales insights and reporting within your PayPal Business dashboard. Keep an eye on transaction details, sales trends, and any other metrics that can help optimize and grow your ecommerce business over time.

Don’t forget to regularly update your product listings and promotions, too. An online store requires consistent nurturing through fresh content and offerings tailored to your target audience. Now that you can easily accept PayPal payments, the sales growth opportunities are endless.

Pros and Cons of Setting Up an Online Store With PayPal

What makes millions of businesses use PayPal, and where can it improve? Let’s take a look at the pros and cons.

✅ Trusted and Recognizable

For small businesses looking for conversions, PayPal offers instant brand recognition and trust. With over 400 million active users, customers feel secure completing purchases through this widely-adopted payment method. Increased buyer confidence helps reduce abandoned carts and boosts sales.

✅ Easy Integration With Popular Website Builders

Worried that adding PayPal will be too technical? PayPal integrates easily with all the top ecommerce website builders like Wix, Squarespace, Shopify, and more. The integration process is straightforward, with clear steps that virtually any seller can follow—you don’t need coding skills.

✅ Simplifies Payment Processing

As a small business owner, you’re pulled in a million directions. PayPal simplifies payments by handling every aspect of the transaction, from invoicing to receiving money securely. You don’t need to juggle multiple systems or worry about fraud protection headaches. PayPal has it covered under one convenient roof.

✅ Comprehensive Reporting

With PayPal’s advanced reporting tools at your fingertips, you can easily track sales metrics that matter most. See your total revenue, payments received, disputes, and more all within your simple PayPal dashboard. Having these insights lets you continually optimize your online store’s performance.

❌ Transaction Fees Can Add Up

While PayPal’s merchant fees are reasonable (2.9% + $0.30 per transaction for online purchases), they can put a dent in your profits over time, especially for low-cost items. Businesses dealing primarily in higher-ticket sales may be able to absorb these fees more comfortably.

❌ Limited Customization Options

PayPal’s checkout process is designed to be seamless but standardized across its platform. So, in essence, you’ve got less ability to customize the checkout experience with your own branding colors, logos, etc, unless you opt for the more expensive PayPal Pro (more on that shortly). But for many small businesses, the trade-off for convenience is worthwhile.

❌ Potential Account Limitations

While rare, some users have reported instances of PayPal holding funds or limiting accounts during periods of unusual activity as a fraud prevention measure. Having constant access to your sales revenue is super important, so such account limitations could impact cash flow if they occur.

The pros of PayPal’s simplicity, security, and market leadership outweigh its relatively minor cons for most small online businesses. As long as you understand the potential transaction costs and limitations, PayPal provides a trusted, user-friendly way to start accepting digital payments with confidence.

What Are Some Alternatives to PayPal?

PayPal might not be for everyone, but are there any viable alternatives out there? There’s no doubt that PayPal enjoys a significant amount of the online payments market share, but it’s certainly not the only option for sellers. Depending on your business needs and priorities, some alternatives may be worth considering:

Stripe

One of PayPal’s biggest competitors is Stripe. This payment processor is particularly popular among larger businesses and anyone prioritizing customization and advanced reporting features due to its robust suite of tools and customization options. Stripe’s pricing is very similar to PayPal at 2.9% + $0.30 per transaction.

Adding Stripe can sometimes prove trickier than PayPal’s more seamless website builder integrations. But if you have development resources, Stripe offers flexibility to customize the checkout experience with your own branding.

Square

If you run more of an omnichannel operation with both physical and online sales, Square could be a good PayPal alternative to explore. Its payment processing fees are also 2.9% + $0.30 for online sales and 2.6% + $0.10 for in-person payments.

Square integrates nicely with website builders like Squarespace and Square Online and provides that unified solution to accept any payment type from any location. The potential downside is having to juggle multiple Square product registrations.

Amazon Pay

For ecommerce businesses already selling on Amazon’s marketplace, it could make sense to use an Amazon Pay solution for your online store as well. Fees are competitive at 2.9% + $0.30 per transaction, with no monthly fees.

The advantage here is providing customers with another trusted, recognized checkout option. But you’ll need to be approved by Amazon for its Pay service, which has specific qualifications for sellers.

Merchant Account

If you’re a larger online business processing over $100k per year, you could save money long-term by going with a dedicated merchant account instead of an aggregator like PayPal. These typically have lower processing rates, around 2% + $0.25 per transaction.

Merchant accounts, however, are more complicated to set up and maintain. You’ll need to be approved and may face expensive termination fees if you want to cancel later. For smaller sellers, those hassles rarely make sense compared to PayPal’s ease of use.

So, summing it up, PayPal remains the simplest and most accessible option for most online businesses and sellers. But it’s wise to evaluate your unique needs as you grow and see if specialized alternatives could be an even better fit down the line.

Are There Any Hidden PayPal Costs?

PayPal has a fairly straightforward pricing model with a standard of 2.9% + $0.30 transaction fee, which we discussed earlier. Although, there are a few additional costs and fees to watch out for depending on how you use the services:

Currency Conversion Fees

If you sell products internationally and receive payments in multiple currencies, PayPal charges a currency conversion fee. This is currently set at 4.4% above the base exchange rate to convert and process those international transactions.

Chargeback Transactions

In the event of a payment dispute where the buyer files a claim or chargeback, PayPal charges a $20 fee per chargeback case. This helps cover operational costs to investigate and resolve the issue.

PayPal Working Capital Loans

If you opt to take out one of PayPal’s working capital loans for your business, you’ll face loan fees that vary based on your credit profile and loan amount. These can range anywhere from 10-30% of the total loan value.

Instant Transfer Fee

If you need to instantly withdraw funds from your PayPal account balance instead of waiting one business day for a free transfer, instant transfers incur a 1.5% fee, maxing out at $15 per transfer.

While these potential extra fees are relatively minor, it’s still wise to understand PayPal’s full pricing structure so you can properly account for those additional costs when pricing your own products and services. Transparency and planning are key for profitable online sales through any payment processor.

Our Testing Methodology

We don’t just skim the surface when it comes to reviews and recommendations. Our team looks at several important factors, including:

- Fees and pricing: We examine the headliner rates, as well as every potential fee, from currency conversions to account withdrawals. Any hidden costs are laid bare.

- Integration and setup: We look at how each payment solution works with multiple website builders and online stores.

- Sales features: What sales, inventory, and business management tools are included? We explore each solution’s full product ecosystem.

- Support quality: We look at the quality of support and how easy it is for you to get help.

When it comes to accepting payments online, PayPal won’t be perfect for every business – but our testing will show you exactly where its strengths lie.

Summary: Setting Up an Online Store With PayPal

With PayPal’s trusted security, seamless integrations, and user-friendly fee structure, there’s no reason not to explore it for your online business. While not perfect for every seller, PayPal provides a refreshingly straightforward way for most entrepreneurs to start accepting digital payments and grow their operations with confidence.

Once you’ve set up with PayPal, make sure your checkout page is optimized for the best chance of converting.

Leave a comment